Please subscribe to my YouTube channel @MoneyWithJames

#Money #Education #StockMarket #RealEstate #Learning #Finance #Investing #Learn #Wealth

Investing in the stock market has many challenges, so in today’s post/video I hope to provide a tried and tested method that I and other professional traders and investors use to increase their chances of making more profitable investments over time.

Let’s get into it!

Step 1 – Decide on your timeframe! As I have mentioned in previous posts/videos, you must decide on your timeframe. In short, you need to decide whether your trade is for a few days or potentially for a few years. As this is really the foundation for the future steps in my method. That said, there are two parts to timeframe. First, the bigger picture, decide your timeframe for your money. Will you need the money back soon for a vacation, or a single serving of avocado toast, a car, etc. Second, is the specific timeframe for this investment and ties into the next step.

Step 2 – Pick your method! The most common are technical analysis (reading stock charts and using indicators, like support/resistance levels) and fundamental analysis (understanding the financial health and growth prospects of the company). My preference is to use a blended method of both. So I start with a fundamental case and then layer over technical analysis on top. Choosing your method ties into your timeframe. Typically, a longer timeframe has a greater emphasis on the fundamental case and a shorter timeframe has more emphasis on a technical analysis case. This is why I like stacking both methods, so I hopefully get reasonable timing short-term and then have a solid fundamental investment case behind it. There will be more in-depth posts/videos to come on building a fundamental case and also on technical analysis, so please subscribe to know once I have posted those!

Step 3 – Build your thesis! The best way to explain this is with a basic example, say Disney stock, currently undergoing a fundamental turnaround with a great CEO back at the top, Bob Iger, it just started to show a profit in its streaming division at earnings last week, a quarter earlier than expected, which many have been waiting for as a sign of strength, plus they just raised their prices to consumers which should feed through to further profit in that division, so some fundamental potential being shown in at least one of their key divisions. Then layer over the chart and you can clearly see it has a very strong range bound history, nearly 10 years. With a strong low support around $80 which has been hit and provided support multiple times which makes it a stronger support level and a high resistance around $120 which has been a resistance level multiple times making it a stronger resistance. So aside from the huge post-COVID breakout up to $200 you have a solid range with strong support and resistance levels. So now you have a combined thesis.

Step 4 – Decide on your conviction! How confident are you in your thesis? Is it high conviction, meaning you want to build a big position? Or low conviction? The example I have laid out is good but not thorough as Disney has two other key divisions I did not mention, so we have not really taken a view on the entire fundamental story, nor have we factored in the global consumer is showing signs of weakness so overall I’d say low conviction fundamentally (without further analysis anyway) but high conviction in terms of the technical levels. So, the key for this step is to then decide how big will this position will be in your portfolio. Small, medium or big. Just for example sake, a small could be half the size of medium and big could be double the size of medium?

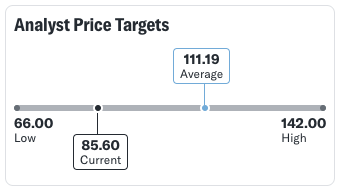

Step 5 – Cross check The Street! This means check what Wall Street or the professionals in your market think of your thesis. This will let you know if everyone else is already agreeing or not agreeing…with your idea. You do not necessarily need them to agree, because having them agree after you start your position can help create the momentum you need. That said, having them agree with you before…you put on the trade is probably more beneficial approach when starting out, so you know your thesis is confirmed by the pros, which is reassuring to know you are on the right track!

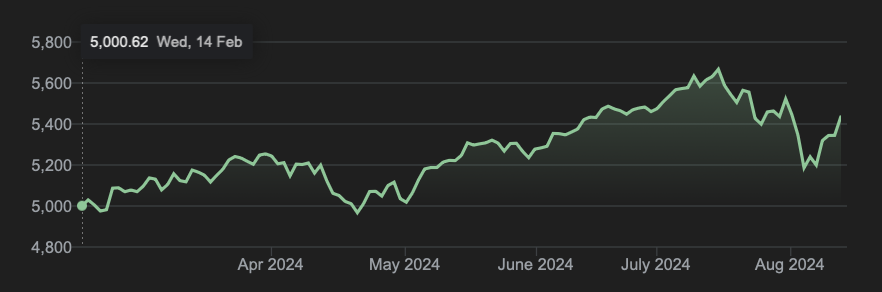

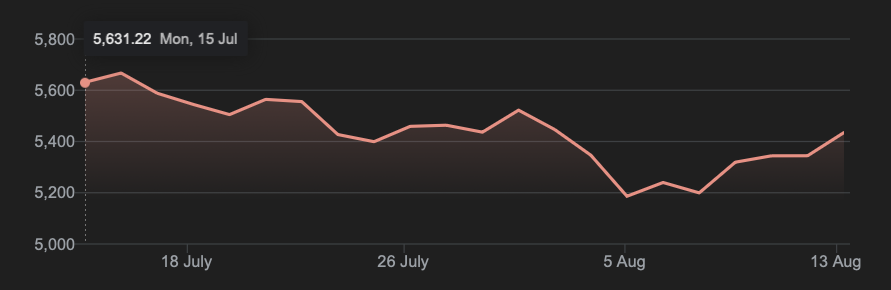

Step 6 – Check the market! Where is the overall market trading? Are we at all-time highs? What is the trend? Where is the momentum? Are we slowly climbing higher or are things more volatile. The famous phrase is bulls (buyers) go up the stairs and bears (sellers) jump out the window. Timing the market is never easy, as nobody has that magical crystal ball to see the future, but having a view and idea of where the market is and what is the current market sentiment is important.

Pro Tip – The VIX – worth mentioning here, that the VIX is widely considered the main fear gauge of the stock market. For every 16 points on the VIX (meaning 16 points of vol or volatility) you can expect 1% volatility (movement up or down) each day in the market. So you can see last week when fears of the Yen carry trade unwind exploded making the Nikkei go down around 13% in one day and then bounce back up 11% the following day and shaking global markets, fueling fears of a US hard-landing (meaning a recession) the VIX exploded from below 16 (less than 1% move in the S&P500 expected per day) to 65!! Meaning expect 4% daily volatility in the entire market! As it turns out, it was substantially overblown fears, as the majority of the Yen carry trade had been unwound already (the market is saying at least 75% has been unwound) so now the VIX is back to 21 so a little over 1% move in the S&P500 is expected per day. So since last week we are now in a slightly more volatile and unstable market environment.

Step 7 – Check the calendar! When is earnings or the next stock specific data due to be released? Companies typically have quarterly earnings cycles. Meaning every three months they make an official public announcement updating the market on how they (1) performed financially in the past quarter, (2) their current financial position, and (3) their outlook for upcoming quarters, so throughout the year there are four earnings cycles. Which occur a couple of weeks after the end of each official quarter. So around…

Late January for the December quarter.

Late April for the March quarter.

Late July for the June quarter.

and late October for the September quarter.

Also worth knowing when is the next key piece of economic data which may affect the entire market or your stock specifically. Inflation data is very hot at the moment as it feeds into interest rates decisions which are really in focus right now. Along with retail sales data and of course new job creation data, which was linked to the big swing last week having weaker US new jobs being created verses expectations.

Pro Tip – 3-Day Rule – most pros follow the three-day rule around earnings for stocks. It’s based on the theory that it often takes the big asset managers/pension funds (often called the smart money or long-only money) three days to digest all the information coming out of an earnings cycle and begin building their new or perhaps unwinding their existing positions, post that new earnings information being released. Therefore, the real trend of what a stock will do after that earnings period is not typically established for three days. So the greatest risk for smaller investors is investing within those three days, and it’s often better to wait for the real trend to be established to see where the ‘smart money’ is going and jump on the momentum then.

Step 8 – Build your position! Most traders and investors don’t buy all at once. They often use the rule of thirds. So once they have established they want to begin building a position they start with one third of their planned position size straight away. Just get it started. Then they wait based on how the stock… and… the overall market… performs following that start. Potentially adding another third later the same day or waiting an entire day or even weeks. It really depends how the stock itself and the overall market trades and… of course your timeframe and thesis… but just know… you do not need to put everything in all at once and the pros rarely do. They always have some extra cash ready to go to help improve their entry price or follow the momentum.

Bonus Tip – Order Types – it’s worth adding you need to understand the main trade order types – limit orders are your friend. This is compared to a market order. A market order means you buy or sell your position value (say $1,000) regardless of price, meaning just buy it now. Whereas a limit order will not start trading unless the LIMIT price you set is achieved and will remain in the market waiting until your entire position size is filled.

Finally, also worth mentioning a stop-loss order that some traders use. This is an order that sits waiting in the market at a set level and once reached becomes a market order to close some or all of your position. For example, you buy Disney at the $80 support level. You then set a stop-loss order at $72 which is 10% below the strong support level we saw and also your entry price. So now, if Disney trades down to $72 then your stop loss order becomes alive and will become a market order and close your position locking in your loss at around 10% (pending how fast your order can be filled of course).

Pro Tip! – Outside Market Hours – some brokers, including Interactive Brokers which is the low cost broker I prefer, allow you to trade outside the market hours. Be aware, often stocks have much greater volatility outside market hours as that is when earnings are released and also much fewer market participants are so price swings are more volatile. This means the chance of getting a bargain or losing your shirt for smaller investors is higher.

Step 9 – Take your Profits! – this is a key step in the method that many new investors do not really factor in. You have designed your thesis and it has worked! Well done you! Disney is now trading at $120, which was your target. Now what? It’s going to the moon! Diamond hands! Hold it forever, hoping to strike it rich because maybe now it goes to $200? Well maybe… but most likely not, this is not how disciplined high-probability trading and investing works. You have your thesis and you stick to it, unless… something material has changed during your timeframe to make you change your thesis. Otherwise you take your profits, you pat yourself on the back…and you find the next investment for your little money soldiers to go back to work.

So that’s it! You now have a professional method for investing! Well done you for watching to the end! It’s worth adding, the whole point of my channel is to teach… and demystify the complicated world of investing. Sadly, once adding complexity it’s easy to get overwhelmed. So please remember what I emphasized in my last post/video. Time IN the market is more important than timING the market and no method is full proof. So please do not get so overwhelmed with the details as you are starting out, that you put your head in the sand and do nothing. The simplest method of buying an S&P500 index tracker and investing regularly is still often the best low risk, low stress, low complexity… growth strategy for the majority of investors. So I wish you all well.

Leave a Reply