Please subscribe to my YouTube channel @MoneyWithJames

#Money #Education #StockMarket #RealEstate #Learning #Finance #Investing #Learn #Wealth

Hello! Welcome! Unfortunately, in most countries today, it has become so much more difficult to buy your first home, due to the ridiculously high cost of housing. In today’s post/video, I will provide some history around this problem and also share some of my favorite hacks, one in particular that is a much safer way for the millions of parents wanting to help their children get on the property ladder. So stick around for those!

So let’s get into it!

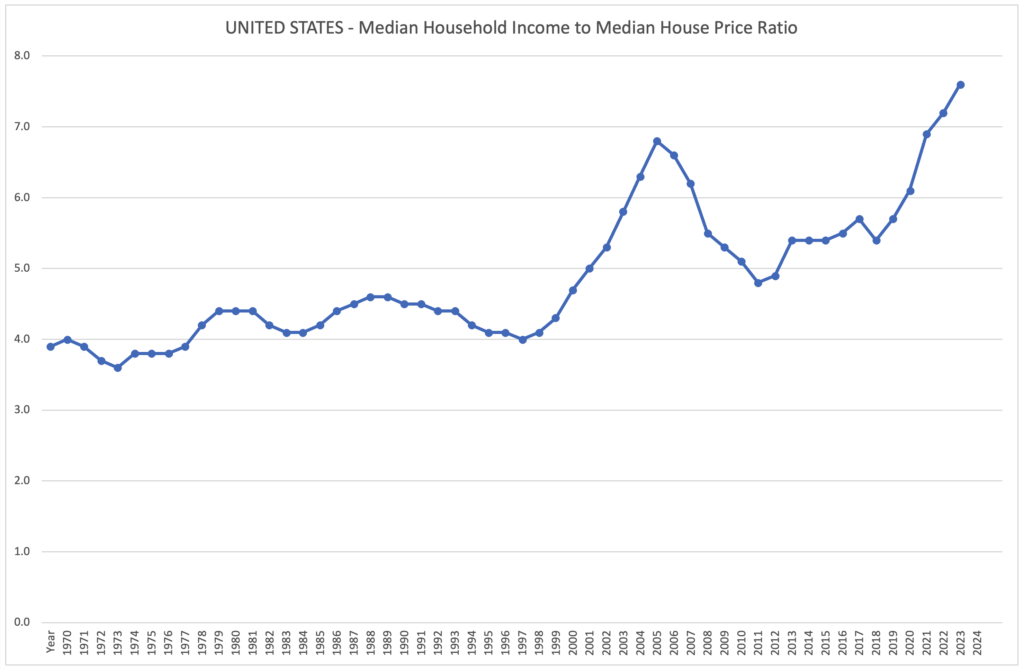

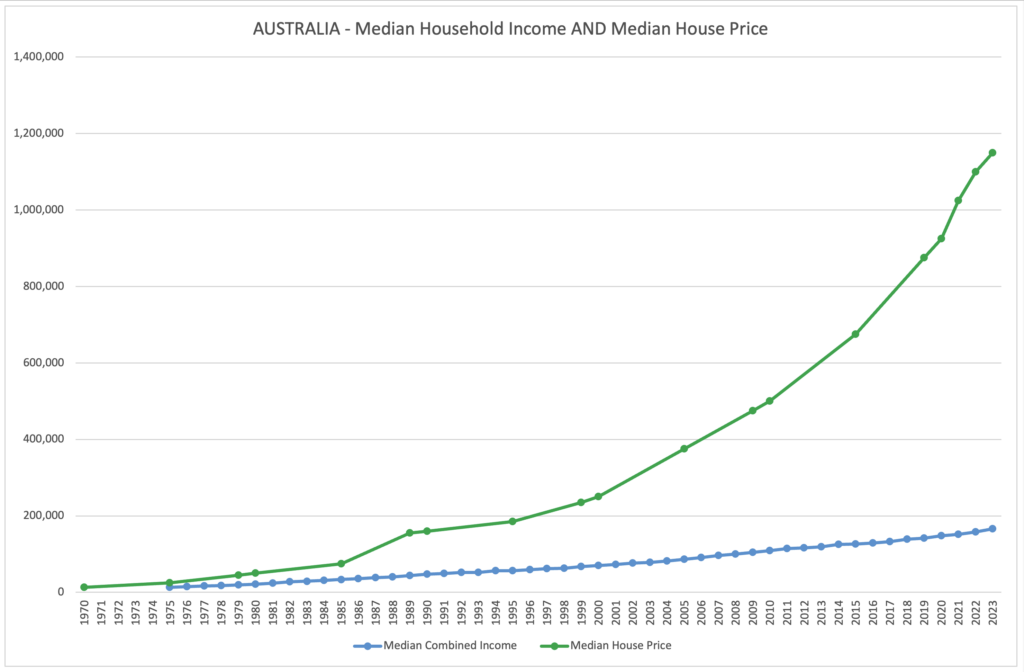

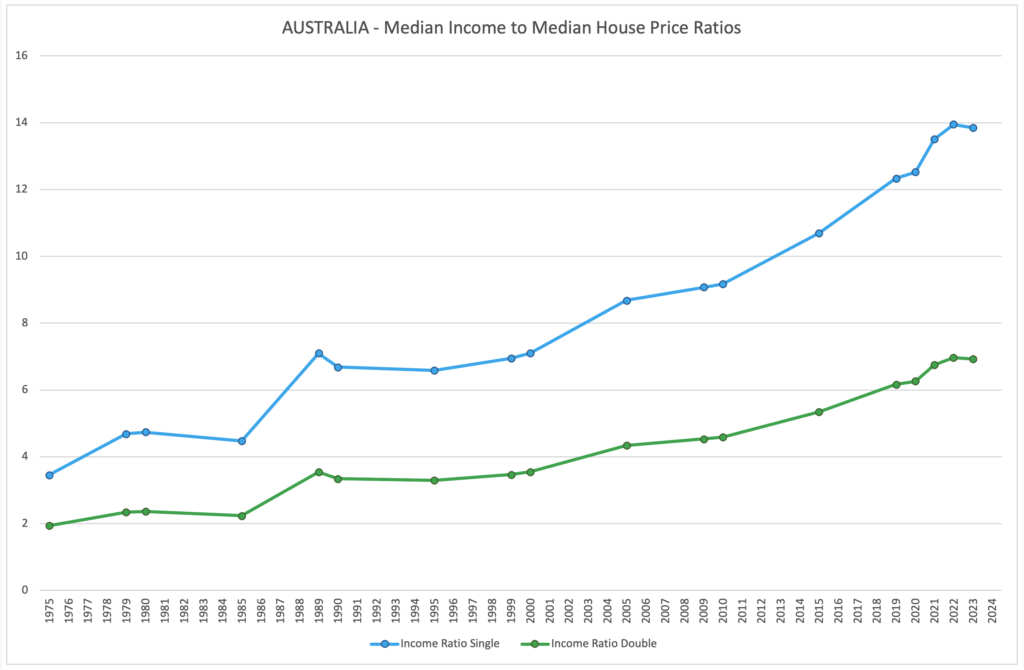

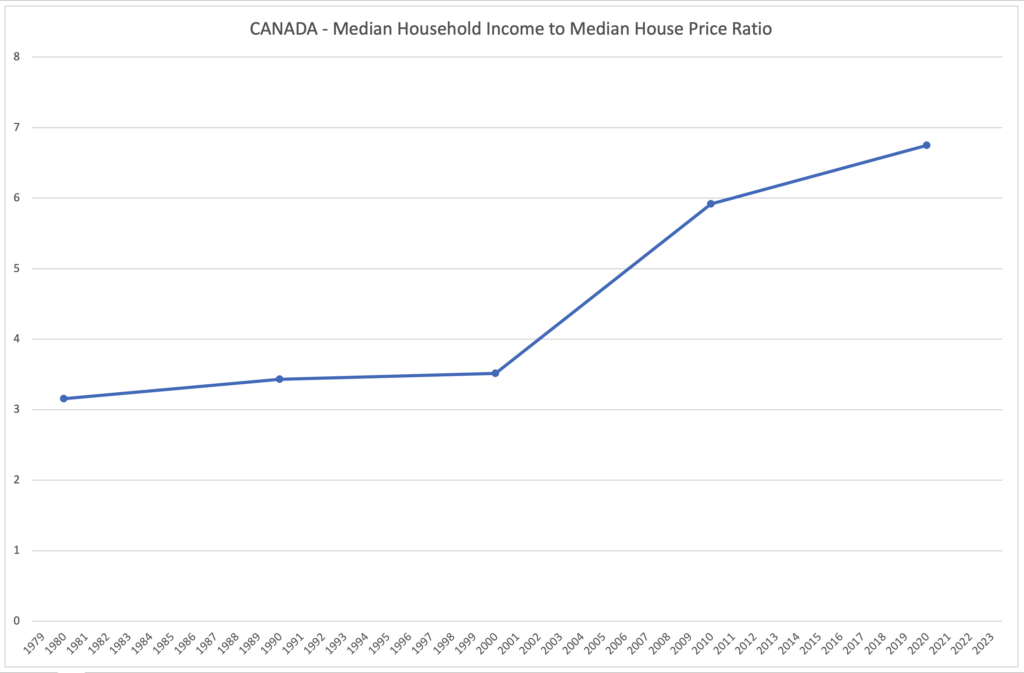

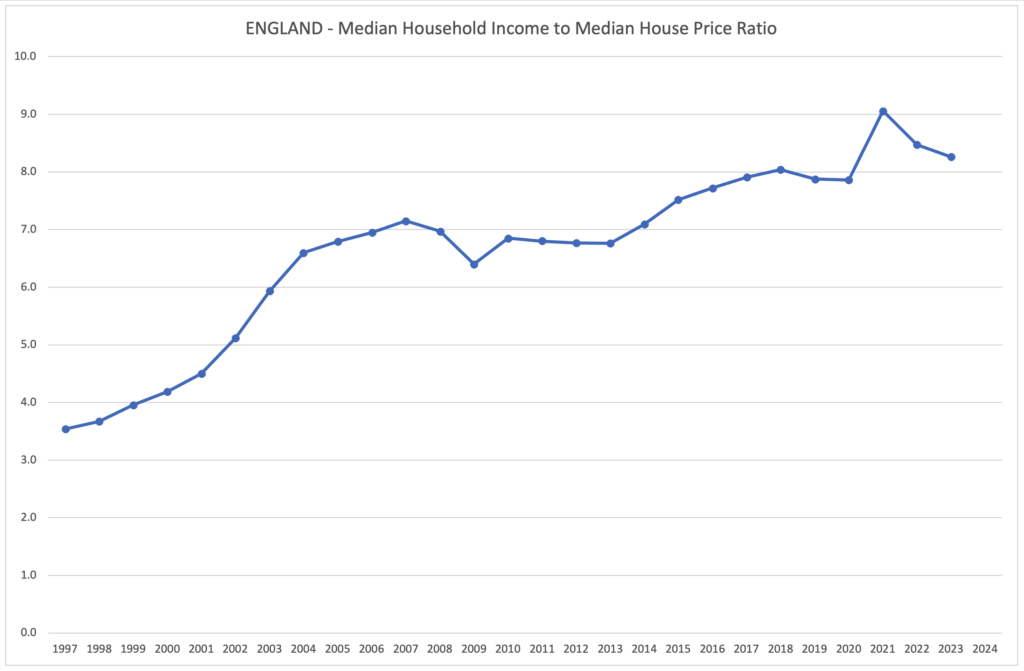

Firstly, I’ve prepared some charts, showing the trend of housing affordability across a few major countries.

Starting with, the United States, you can see back in the 1970s median household income to median house price was around 4x and remained that way until the 1980s. When it climbed a little before levelling off. It wasn’t until the 2000s when it spiked to nearly 7x during the Global Financial Crisis. Before it came back down to 5x. Yet you can see we have now hit an all-time high of 7.6x.

Please note, the income side of this data is household income, meaning back in the 1970s that was typically just one income whereas today that is typically two incomes. So when you think many households include two incomes today and affordability is still twice as hard, that is really quite a sad reality of times today.

Second, we have Australia, where I have data for both median income and also median household income. You can see if you are a single income household it has gone from 4x in the 1970s to now a staggering 14x. Thankfully when measured as household income it is around the same as the US at 7x today.

Of course, pending which city you actually live in, the reality can be somewhat worse than this or somewhat better. As bigger cities typically have higher incomes but also higher house prices, unfortunately often the bigger cities are worse in terms of affordability. Checking the data, for Sydney for example, Australia’s biggest city, it is around 15x for median single income, which means for global rankings it places second as the most expensive for housing affordability, second only to Hong Kong which is a staggering 25x! The footnote to this is getting matching income data to high house price data is not so easy.

Third, I’ve looked at Canada, which on household income is also about 7x for household income today. Yet, Toronto, Canada’s biggest city, is around 12x household income.

Finally, I looked at England, which is up over 8x now compared to sub 4x 25 years ago.

There are a couple of caveats to keep in mind with this data, however.

Firstly, the income amounts I’m using are medians, not averages, this means that, while the ratios should be indicative of most of us ‘middle class’ types, they might be inaccurate for the lowest and highest paid income earners.

Secondly, the data is nationwide and therefore doesn’t account for differences between cities or states. As I have highlighted with my Sydney and Toronto examples, the micro picture within a country can be much worse than the entire country picture.

I imagine for most watching this, it is not new news to know that housing is unaffordable. It is absurd where things have reached and sadly there aren’t many government policies which are going to help turn this tide. Therefore, most countries are simply accepting that in the future there will be a growing proportion of society that will be lifetime renters. The American Dream, The Australian Dream, the dream for so many to get on the property ladder is now moving further out of reach for so many.

So what can we each do about it?

I have some real-world ideas that I hope will help some of you get ahead and fight this overwhelming tide of unaffordable housing.

Idea 1) Buy a house with your friends or family/siblings, etc., so what does this mean, an example, you have finished high school or college and started work.

You have an income! Yay! Well done you!

You decide it is time to move out of your family home and rent somewhere. Perhaps instead, either now or in a year or two, you seriously consider buying a share house, instead of renting one! Yes, there are complications with joint ownership etc. but if you make the deal with your friends/family that you are buying it for 3-5 years and will then sell it and use the proceeds to each buy your own individual home then there are so many positives.

You avoid throwing away rent.

You get on the property ladder earlier.

You can renovate it and add value to it together.

You have far more adulting life lessons earlier to learn from.

You get to live with people you know and love.

You can also get more creative and with an extra bedroom, or if circumstances change and one person needs to move out, then rent that out spare rooms to strangers or Airbnb.

Idea 2) The Bank of Mum and Dad hack! Although, sadly not available to everyone, this idea comes with a special James twist!

So many young people find the greatest obstacle to buying their first home is getting the money saved up for the deposit. So they continue living with Mum and Dad well into their twenties and even thirties, they live frugally for many years, saving every penny they can, limiting their brunches of avocado toast and coffees and Uber rides and then find that house prices have gone higher again and all that they have saved is still not enough!

So they go to the Bank of Mum and Dad and now ask them to be guarantor on the loan and co-sign to use the family home as collateral and security to allow them to buy their first home finally. The bank is really happy. They get a huge margin of safety and will happily come take the family home if you fail to cover your own mortgage. This strategy sadly puts a huge amount of stress and risk onto Mum and Dad who are now finally starting to enjoy their older age in peace with some financial stability.

I am not here to support ripping off your parents! They deserve their peace. What I am suggesting bridges the gap and lowers the risk. Instead of asking your parents to guarantee your entire loan, instead ask them to go see their bank independently to you. Get a loan of the minimum deposit you need, ideally on interest only repayments.

So $50,000 or $100,000 pending your country and city. They have then created a loan and some risk for themselves but it is nothing like guaranteeing your entire loan for $500,000 or a $1,000,000. Pending your parent’s financial situation they can cover the interest on that loan to you or you can then set up a separate loan agreement with your parents. Whatever interest rate they have to pay on their new loan for your deposit you pay entirely to them each month so it just washes through their account. They have some risk but no actual cost. It’s kind of an equity release loan for them.

Generally, any large amounts of money given to children from parents are deemed to be gifts in the eyes of the law, pending your legal jurisdiction, but I would personally still draft a basic loan agreement for your parents just for your own records so they have legal claim to their deposit loan if need be. Please check out my resources page where I have a basic legal agreement that could be used just for you and your parents to sign and each keep a copy. Although there are many templates available elsewhere online.

Then, of course, you cover the payment on your own larger loan and boom, instead of waiting 5 years to save up the deposit you have your own property as soon as you can get approved for a mortgage – so likely just a few months after getting your first full-time job!

Now I am not saying this is risk-free or guaranteed to work for everyone, it depends on your actual income and house prices in your city, but as a safer option to reduce the huge exposure for your parents signing guarantor against your full loan or at the other end not helping their children at all. This gives a great option to help but also reduce their very real risk.

In the unlikely event you fail to pay them back or you fail to pay your own mortgage and the bank forecloses on your home then your credit rating is destroyed and you lose your home but more than likely they do not, as your parents have a much smaller risk. They must cover their deposit loan with their bank but not your entire loan. So it is a lesser of two evils outcome in the event of a disaster.

Leave a Reply