PLEASE CLICK HERE TO SUBSCRIBE TO MY YOUTUBE CHANNEL @MoneyWithJames

#Money #Education #StockMarket #RealEstate #Learning #Finance #Investing #Learn #Wealth

Why do we need financial advisors…? …why do we PAY financial advisors so much of our hard-earned retirement money…? The availability of free, credible, information sources has never been greater than it is today.

Yet for some reason, many people, especially the baby-boomer generation, like my parents, and many parents of friends and family I know, seem to think they are too ill-informed to take charge over their retirement funds.

Today I am going to challenge this idea with some serious questions for EVERYONE to consider. Whether you are at, or approaching, retirement age or even 40 years away from it…what I discuss today is truly important for everyone to consider.

So let’s get into it!

So why do YOU need to pay attention to THIS post/video? I’m going to start with a personal story to illustrate why. I come from an average middleclass family. Grew up in the suburbs. Both of my parents worked hard to provide for me and my siblings.

My father worked for the same company for over 40 years and continues to work today into his seventies, not to be rich but simply to live a peaceful and modest life.

My mother also worked full-time for most of my childhood school-age years and continued well after I moved out of the family home. They have never wanted for much, especially luxurious or opulent things, they instead chose to save and put money away for their retirement.

So what are they doing today? Now, as empty-nesters, both of my parents passed retirement age many years ago. They have retirement savings invested according to their own choices and they hope that they will have enough to provide a nice life during their golden years.

Sadly, even though they are both very smart, educated, more than capable and also disciplined people, up until recently they chose to give away the majority of their retirement-money decisions to a financial advisor and did so for over 20 years.

Why did they do that…? Mostly because they worked so hard for their entire lives and never really had time or really had access to trustworthy financial education.

But more than that, they feared what could happen to their future nest egg and did not want to risk losing it because they alone made a bad decision.

So it was down to fear and a lack of education which drove them. They felt like they were not able to transfer the skills they developed in life to confidently make their own financial decisions. Because, like many, they thought big financial decisions are risky and SCARY and far too complicated for them to truly take charge of.

What was the CONSEQUENCE of this decision for my parents? I will show you shortly so stick around.

What do I think my parents and many families like them should do instead? Firstly, I think it’s time to spread the word that not trusting yourself to make these decisions is nonsense for most people today. So get the heck out of here with this self-doubt! This type of thinking had DISASTROUS consequences for my parents and continues to have disastrous consequences for so many families today. Unfortunately, come retirement day you are likely to find a lot less in your pension pot than you hoped for.

Why do I say that…? Across most major countries, like the USA, Canada, the UK and Australia, the average financial advisor charges both an upfront and ongoing annual fees. Which is fine in some cases but the devil really is in the details here.

Can you guess why…? The reason is when these fees are charged…as a percentage-of-portfolio…or otherwise known as based on assets-under-management…then keep watching, as you are going to be blown away at how those fees kill your returns! And therefore your retirement funds!

I will show you some data shortly but first, generally the ongoing annual fees from many advisors range from what sounds like a tiny 0.5% to 1.5% and occasionally up to 2.5% or more.

With the higher fee being more common just in your first year when making an initial investment, as advisors justify the higher fee by providing a nice glossy plan for you. Sadly this is precisely at the time when you want your portfolio to be starting with as much as possible they take more out of it!

Then as part of their ongoing fee service they offer you things like the option to call them whenever you like throughout the year and they will ‘rebalance’ your portfolio each year to justify their fees.

But what does this actually mean? And are you actually getting fair value in services, and most importantly in returns, for the fees paid? Firstly, most people, just like my parents, never actually call their financial advisor each year. So you aren’t receiving value for this service.

But what other services are there? Surely they pick better investments right?

Before we get into that, let’s assess what the true cost of fees based on a percentage-of-portfolio is?

Thank goodness my parents no longer utilise the services of their financial advisor because of this juicy fee structure but unfortunately they did so for about 20 years.

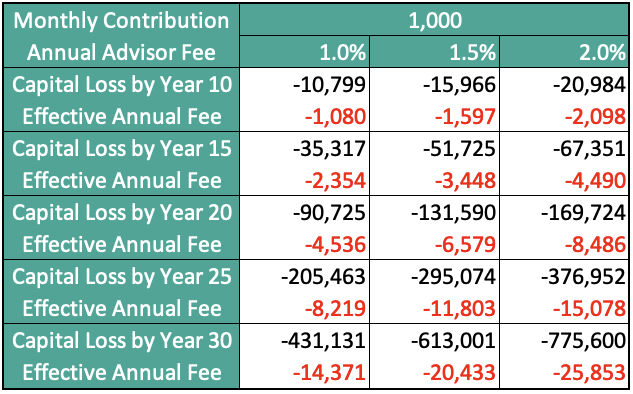

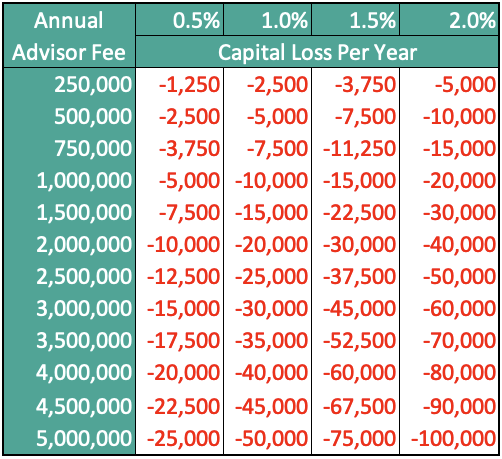

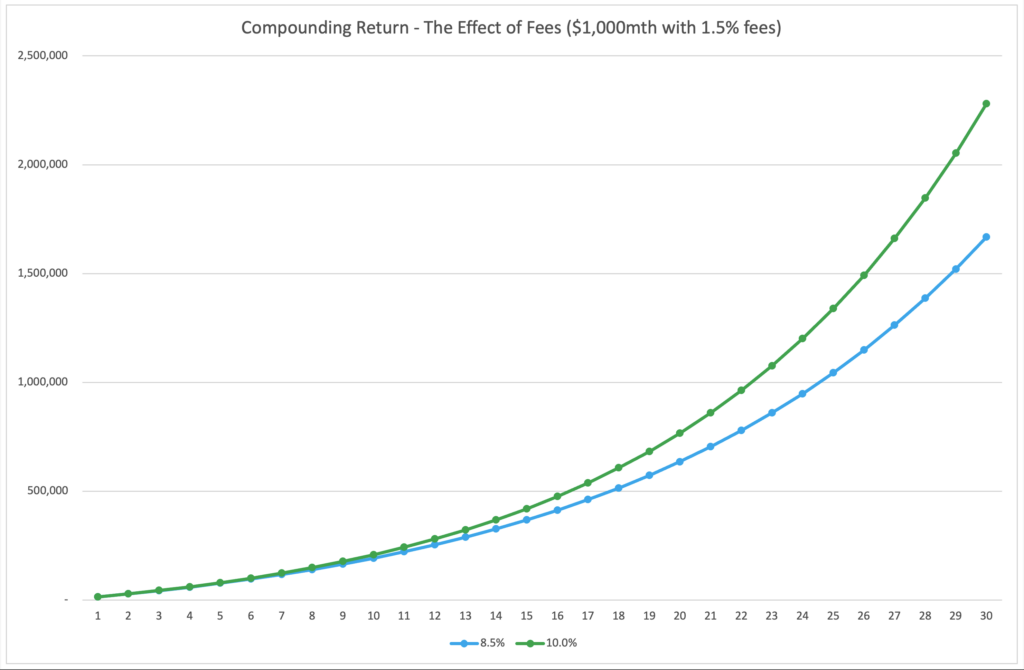

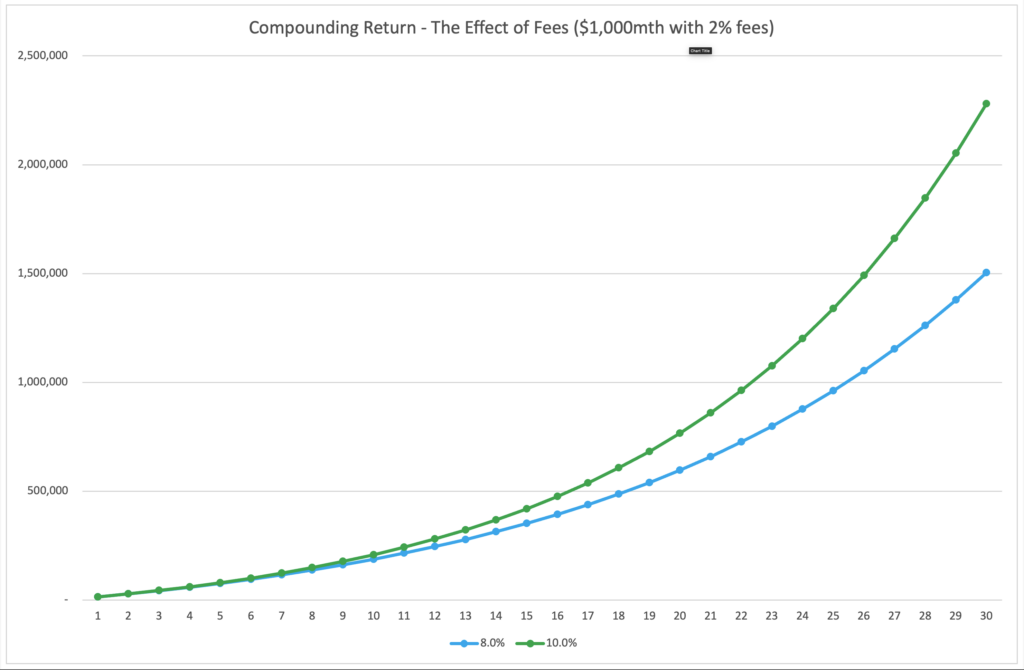

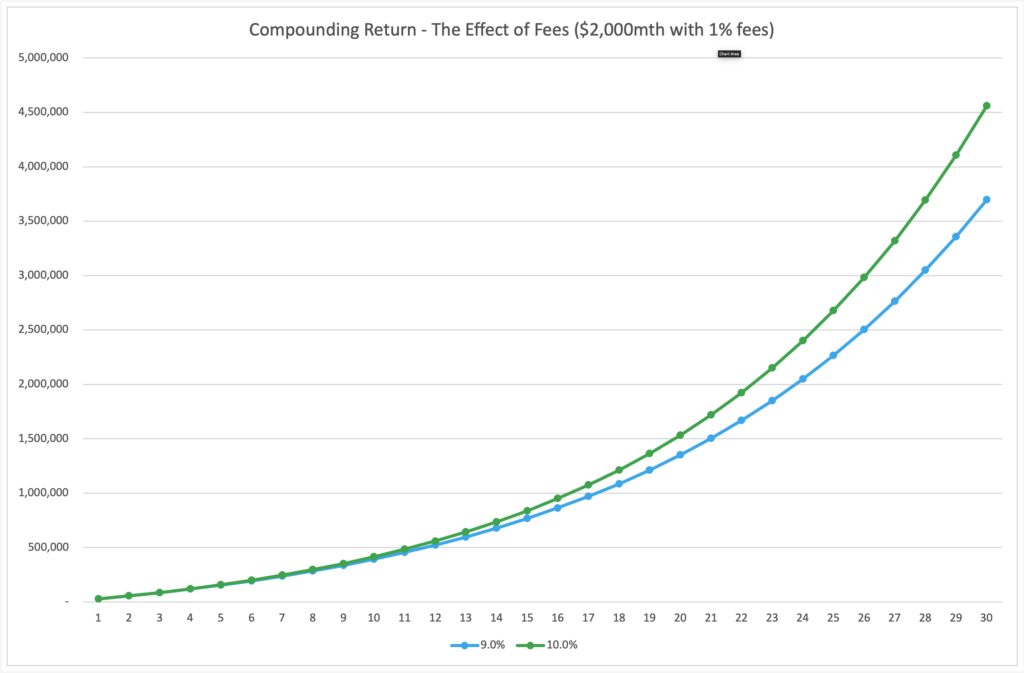

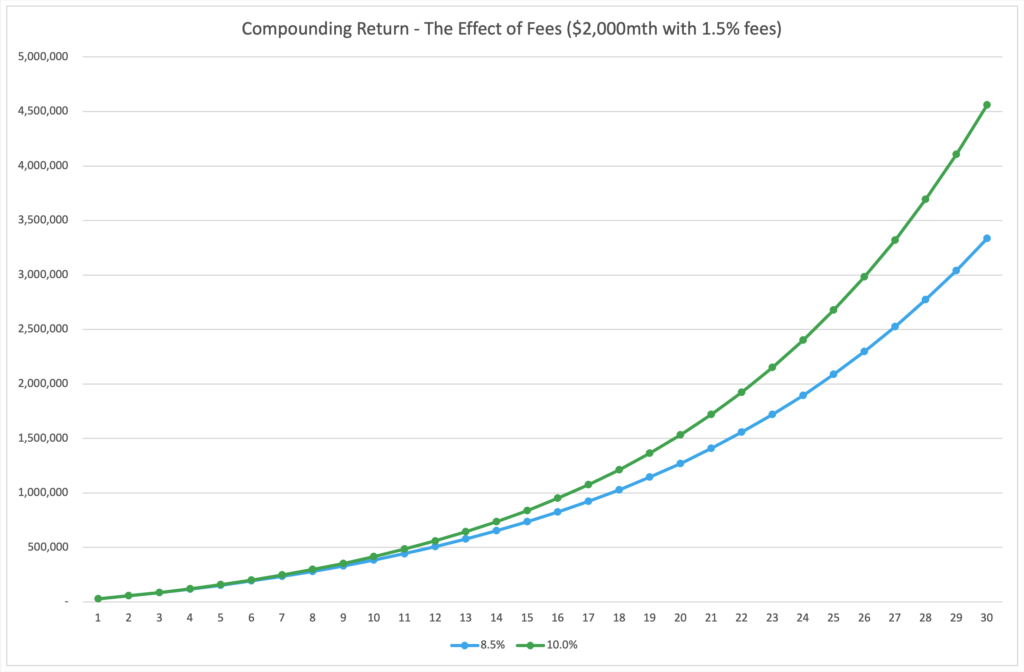

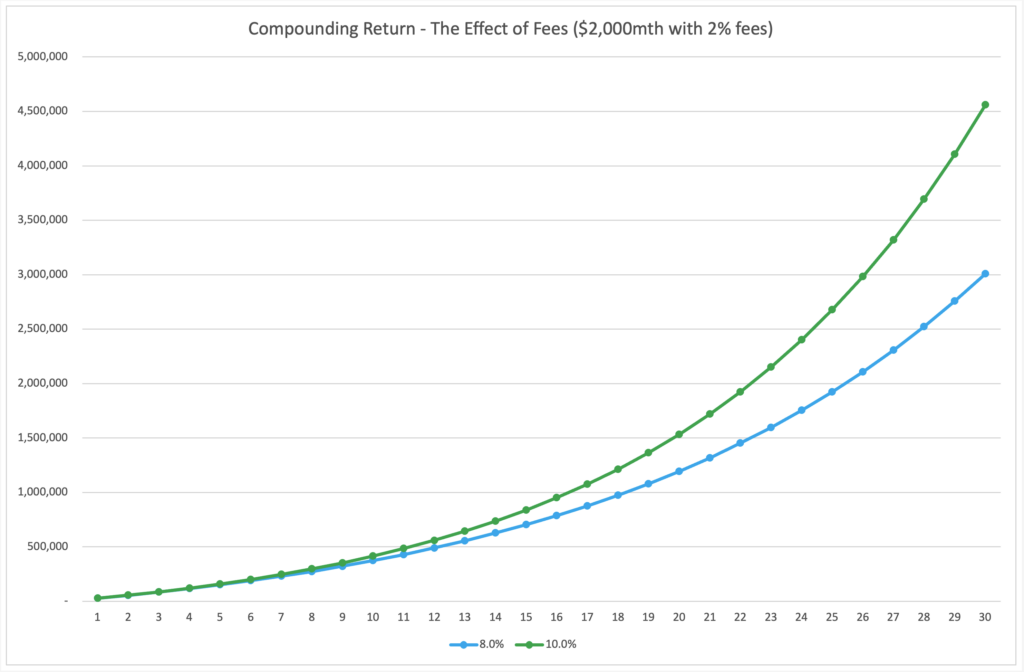

So what happened? It’s actually quite devastating. Please look at these tables. When you compound a return at 10% (a reasonable average long-term return) over 30 years versus a return less a financial advisor’s average fees you will see what happens.

Let me explain what you see here. The first table assumes you or your employer are investing $1000 each month in your pension, and the second table $2000, over 10, 15, 20, 25 and 30 years.

Now you can see the impact on your capital of having a 1%, 1.5% or 2% juicy fee taken from your returns each year.

Then in red, this is effectively what you are therefore paying your financial advisor on average each year. Look at how big the negative impact grows to, as either time passes or your pension grows!

If you stay with an advisor for 30 years and pay just 1% are you really getting half a million to one million of value for their services?

You want to know the worst part, which you will see in the charts I show shortly. For the $430k you pay away over those 30 years that equates to 19% off what would have been your portfolio as these numbers only work out to create a $2.3M portfolio.

If we ignore the precise numbers, the tables also show that as your capital doubles, the fee in real-money paid to your financial advisor also doubles. So the key question to ask yourself is, does the value received from the financial advisor double? So should someone with a $4M portfolio pay double that of someone with a $2M portfolio?

Furthermore, the tables show, moving left to right, as the fee increases, by what sounds like such a minuscule amount of 0.5%, due to the magic of compounding, it actually creates a significant amount of capital loss.

So whether you have a small amount in your pension, and certainly if you have a million or more, then there are serious questions to ask in terms of paying a percentage-fee, even a tiny percentage!

As you can see that even at the smallest end of my example you are still effectively paying over $1,000 per year over the first 10 years, which then becomes $5,000 per year after 20 years and blows out to $15,000 effectively paid each year after 30 years – because in the final years the amount taken by the same percentage is so large.

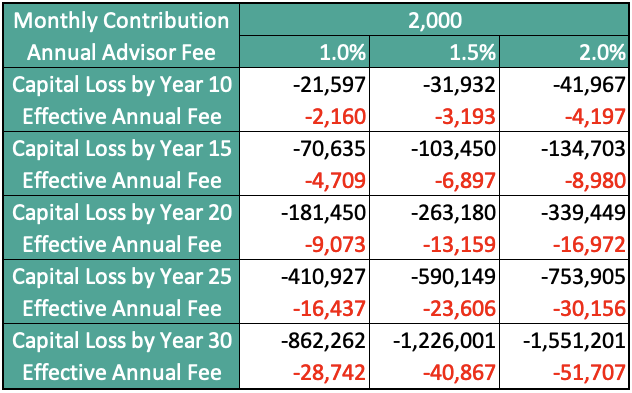

Another way to look at it is simply based on the amount you have in your pension. See this table. Do you pay your accountant that much? If not, then please reconsider how much you pay your financial advisor.

This is an annual fee, so every year your portfolio value is this big you pay away this much in real terms. So if you are lucky enough to have $5M invested for your retirement do you really want to pay away an entire luxury car in fees each year?

Check out these charts to show how the impact grows as the size of your portfolio grows and therefore how much worse this impact is for most of us in our final years as we build the most in our pensions.

First chart, $1000 per month at 1% annual fee…

Second chart moves to 1.5% annual fee…

Third shows 2% annual fee…

Now $2000 per month at 1%…

Then 1.5%…

And 2%.

Now it is very important I highlight that my examples make a huge assumption. Have you realised what that assumption is…? I am assuming you will make identical investment decisions and therefore achieve identical investment returns under both scenarios.

A scenario where you are guided by a financial advisor taking a percentage-fee and a scenario where you are not.

Is that a fair assumption…? Most financial advisors who wish to take a percentage-fee will likely sell you on the possible outcome that they will be able to pick better investments for you and therefore improve your returns far beyond their tiny fees.

Should you believe them…? Well, if they have time machine or… a crystal ball, then yes!

Otherwise, while their hypothetical predication of getting you better returns could certainly be true…the only question you should ask is…is it likely to be true?

I propose it is unlikely to be consistently true and sadly, it is more likely you are depriving your future self of a larger pension and therefore also depriving your children of their possible inheritance.

So why do I question their prediction…? Firstly, many financial advisors recommend managed funds for you to achieve your returns, as many advisors get juicy commissions for investing your money in managed funds.

Of course,… they would argue they are choosing the right funds that align with your risk profile – which they typically determine through a risk assessment.

Which generally becomes as simple as taking your age and turning that into a percentage and then using that percentage as the amount to go in fixed income investments (meaning at age 50, 50% should be in fixed income and at age 60 then 60%).

I’m simplifying their process significantly but not entirely as on average this is how it works out.

What else is a serious concern? Sadly the data shows that over the long term the majority (>75%) of actively managed funds underperform passively managed (index tracker) funds. And considering pensions are long-term products, why would you go against these statistics?

And why else do I challenge their prediction? Well…and this is maybe the biggest issue…typically those managed funds that advisors recommend have their own juicy percentage-fees…which are also around the same level of 0.5% to 2%, and occasionally even higher.

So now to summarise, you could be losing 1-2% to the financial advisor, a further 1-2% to the active asset manager and finally the evidence suggests you will also underperform the cheap and easy strategy of using broadly diversified index trackers? So just on fees alone you are likely substantially behind but if you are part of the 75% then you are likely even further behind.

Therefore, you can now go back and double all those amounts I showed in my tables and charts above. Ka-Boom! Bye-bye pension! You have now just lost twice as much! Yay! That’s sarcasm to be clear.

But this is no joke and truly a disaster which has affected and continues to affect millions of families all over the world. Hence the need for this message to reach as far as possible.

So am I being fair with my message so far? I do not want to be all doom and gloom. Many financial advisors offer valuable advice on effective tax planning and risk minimisation and investment options.

So…what is my message then? My key message is…if you feel you need a financial advisor because your investment plan is quite complex with various companies and different income sources, or…

you are too busy to learn the basics of what you would need to know, or…

you truly think they will get you a consistently better return, or…

you just want to be sure you have ticked all the boxes…

Then be sure to find a good financial advisor, and by good I mostly mean one that will happily offer their advice with a fee-for-service structure, just like an accountant.

What does that mean? It’s in the name, you simply pay them by the hour. Please do not be fooled by the flat-fee once-per-year fee structure many try to offer nowadays, which oftens adds up to many thousands or tens of thousands as a one-off fee each year.

I am not a supporter of this single large annual flat-fee structure either.

So if your chosen advisor does not offer you the ability to pay by the hour and equally important that their hourly fee is reasonable (similar to that of a good accountant in your city) then I strongly think you consider finding another advisor.

I have a no greedy advisor policy.

When should you go see a financial advisor? Well how long is a piece of string? Nobody can see the future but what can be valuable and worth paying your financial advisor for every year or every few years – even for just a 15-30 minute call – is to check on law and tax changes that you could take advantage of.

Although a good accountant may be able to advise you of many of these changes or just check your government’s websites or even YouTube is full of great free help.

That said, if you do have a relationship with a good financial advisor then they will likely send out an email newsletter each month or quarter keeping you up to date on these changes prompting you to think about it and perhaps put in a quick call when you feel it is necessary.

What questions should you not pay your financial advisor for? I would not waste much time discussing when the next market will crash will arrive…or how much the market will go up this year, as these questions are tough to answer. So don’t waste your children’s precious inheritance on such questions.

How do I suggest the majority of my family and friends invest their pension? Very similar to how I suggested in my earlier post/video about timing the stock market.

First, I suggest they set up a tax effective structure in whichever country they are tax resident (so a 401k, an IRA or Roth IRA in the USA; a SIPP and an ISA in the UK; a self-managed super fund in Australia).

Then what do they do with that tax effective structure? Invest just like Warren Buffett suggests and how I highlighted in my previous post/video. Don’t make it complicated.

Most average families can follow this strategy. Invest regularly into a broadly diversified low-fee fund like an S&P500 index tracker or equivalent, ideally adding more during 20% or more market downturns – of course factoring in their home currency and how many years they are from retirement.

And what should they consider as they approach retirement? Once they are around 10 years away from wanting to draw on their retirement funds it certainly starts to make sense to ensure they create around two years of estimated living expenses in fixed income or liquid investments so it’s ready to draw down.

Then as their chosen retirement date is just a few years away consider increasing this amount to 4 years, and if they want to be very conservative then as much as 8 years, living expenses in fixed income type investments.

Any remaining capital beyond their chosen liquid/readily accessible amount is probably better off remaining in growth investments like the S&P500.

Especially if the central banks around the world continue to play the money printing game and destroying the value of cash with inflation and artificially blowing up the price of assets! We will all be much safer having some assets in this future!

Why do I recommend this approach to my friends and family? Most importantly, it’s easy and therefore achievable and therefore…relevant for most people.

Of course, more complicated strategies and time intensive approaches can be considered by those who wish to, and I will get into that on this channel in future, but for now I wish to focus on what is appropriate for most people.

So by taking this approach, of low-cost investing and dollar-cost averaging, you do two very important things.

Can you guess what they are? Firstly, and most importantly, you eliminate the ongoing percentage-fees from both financial advisors and mutual fund managers. Thereby guaranteeing you increase your returns by those saved fees.

Likely saving around 2-4% annually which as I have already shown has a substantial benefit over 20-30 years and with large fund balances.

Secondly, and equally important, you continue to invest during ups and downs in the market cycle, ideally adding more during the downs, as…what is my favourite quote? “Time IN the market is what matters more than timING the market!” Round of applause for those that are starting to say this quote with me as I say it!

Now if I can please ask you a favour? I feel this is a really important post/video, so please share it with your friends and family, as I hope to help change the destruction of so much retirement assets for so many families all around the world – as I know we will all most certainly need it!

Leave a Reply